AliExpress is a famous e-commerce platform owned by the Alibaba Group. It consists of retailers and suppliers based in China. They sell items per single unit or wholesale to international buyers.

With over 100 million users worldwide, Aliexpress boasts of being one of the best websites. Yet, some buyers complain about the high import taxes and customs.

What are these import taxes? Do you have to pay Aliexpress customs? Well, every buyer importing goods should have a basic knowledge of import taxes.

This article is going to highlight Aliexpress taxes in USA, Canada, UK, and France.

Table of Contents

ToggleWhat Are Aliexpress Taxes?

Import tax is the tax charged on goods bought from abroad. Every country charges different import taxes. It depends on the package’s value, product category, size, etc.

Buying from Aliexpress is swift. Once you get a supplier and agree on the MOQ, you can pay for the items. But before shipping, always ask the seller if you need to pay import tax or other customs charges.

1) Aliexpress EU VAT 2021

From July 1, 2021, buyers need to pay VAT on all products they import from Aliexpress. It is due to the implementation of IOSS, i.e., Import One Stop Shop.

The VAT 2021 tax was implemented to ensure taxes are paid for all goods and services in the EU.

The standard VAT rate in the European Union ranges between 17%-25%. Some countries offer a lower rate on various items.

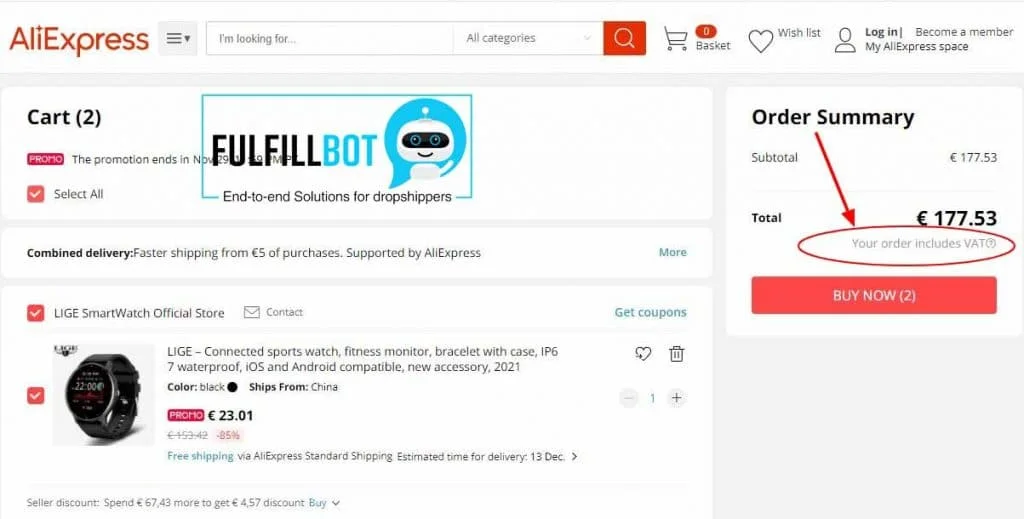

For people living in the European Union, you won’t be charged VAT directly. Instead, the new rules allow Aliexpress to handle taxes on products below 150€.

The EU VAT 2021 reforms have made things easier for you. Once you’ve paid the IOSS, you won’t be required to pay at customs clearance. Aliexpress will take care of everything.

For this reason, you will pay VAT to Aliexpress. Every country has its minimum valued price. Thus, you have to research what maximum amount your country has set.

Paying VAT to Aliexpress won’t affect your shopping in any way. Instead, it will make things easier for you. Once you pay the tax on this platform, you don’t have to pay it again.

You can check what amount of tax to pay on Aliexpress by clicking on the order summary page.

2) Aliexpress Import Tax USA and Canada

In the USA, items under $800 will be tax-free. All credit for this goes to the Act of 2015 regarding Trade Facilitation and Trade Enforcement. That’s because this act states that Goods below $800 can be excused from customs.

But remember that the $800 value belongs to the per-day quota. Suppose you have different packages coming on the same day. Then, customs officials might open all the packages to see if their total value sits below or exceeds $800.

If your package exceeds $800, you’ll need to pay a 25% tariff on them. So it is best if you split big orders into small packages and spread them across different days.

Canada, too doesn’t tax packages valued lower than CAN$20. The government collects the goods and services tax (GST) of 13% for high-price products.

You can pay customs in Canada by accessing Canada Posts “track tool.” Different provinces in Canada collect GST and PST (provincial sales tax).

It includes Manitoba, British Columbia, Nova Scotia, Prince Edward Island, among others.

3) Aliexpress Import Tax for the UK

In the UK, buyers are to pay import tax on all Packages imported. Paying VAT on Aliexpress lessens you a lot of paperwork. It applies if the order is below £135.

A 20% of the total goods is what you pay. Aliexpress tax then sends it to the UK Tax Authority. Thus, it exempts you from paying tax when your package arrives.

For orders above £135, buyers need to pay the tax plus import duties. The carrier will let you know if you have to pay customs once you receive the package.

It is approximately 20% of the value of the package plus the customs and holding fees.

Aliexpress needs to collect Vat at the applicable rate. Then, remit to the UK tax authority when goods are sold to UK customers.

But note that the VAT rate also depends on the package content. Some products, like baby clothing, have 0% VAT.

4) Aliexpress Import Tax in Australia

Purchases under AUD 1,000 need to pay customs fees through Aliexpress. It is usually a 10% deduction, which applies to the shopping cart.

Aliexpress collects the Goods and Services Tax (GST) from buyers. It then forwards it to the Australian government. As a result, it excuses you from paying taxes once your package arrives.

You might get a notification with the documentation you need to provide and steps to follow.

After that, your package has to go through customs in Australia and China. It helps avoid the shipping of illegal materials.

How Can You Avoid Taxes on Aliexpress?

Remember, Import taxes are your responsibility. They don’t belong to Aliexpress. You can follow the below methods to avoid, or at least, lessen the Aliexpress taxes.

A) Don't Exceed the Minimum Value

To avoid Aliexpress taxes, you need to keep the value of your purchase below a specific value. Of course, this minimum value depends on your country. We have already covered these values in the above sections.

B) Split Your Orders

Depending on what country you are in, check what package values they exempt taxes. If you have bigger purchases, divide them into small packages.

C) Choose the Right Shipping Method

Choose Airmail instead of DHL for Aliexpress import. It is for imports with a higher value than the required amount. Also, if the package is smaller, the chances of customs opening your package are low.

Many shipping companies state the exact amount of the Aliexpress import. Remember, private shipping companies will always attach the product value to your package.

D) Buy from a Local Warehouse

Another option is to buy from a local warehouse. Aliexpress has many warehouses in the USA and Europe. If you get your item from a local warehouse, you won’t have to pay customs.

E) Go For Tax-Free Goods

You can also opt to buy items that the seller has specified to be “tax-free.” That is, without customs. This way, customs won’t charge you when your package arrives.

Need Sourcing Agent & Dropshipping Agent?

👇👇👇👇👇👇

How to Handle Aliexpress Taxes as a Dropshipper?

All e-commerce businesses must pay product taxes according to the trade policy. Dropshippers have various ways to go about this.

An option is to have VAT deducted by Aliexpress and then paid to the required country. In this way, you’ll ask your client which country they are in now. Then, pay the import tax and customs fees on their behalf.

This way, when their package arrives in their country, they won’t pay the tax again.

Also, you can opt to have your client pay their custom and import fees. They can do this upon the arrival of their package.

Suppose you are dropshipping through Shopify. Then, you are obligated to pay Shopify sales tax. It is the tax imposed on goods you sell. Sales tax can vary depending on the location.

Another way is to pay for the taxes. So, if your client is charged import and tax fees again, you can apply for an EU Tax refund with Aliexpress in case of this.

Is shopping on Aliexpress dead for EU?

Final Thoughts!

Almost every buyer needs to pay Aliexpress Import taxes and customs. Likewise, every country has its regulations.

Thus, you have to do your research on the tax policies set to be safe. As a result, it will help you avoid having your goods being grounded at customs.

For a drop shipper, communicate with your client and agree on ways to cover the import taxes. Moreover, you can tell them about the regulations set after the EU VAT 2021.

Lastly, make sure you pay VAT through Aliexpress in most cases. That way you won’t have to pay them again. Note that Import tax and customs are different things. Both need different documents, too. Also, make sure you use airmail instead of DHL and other shipping companies.

If you keep these tips in mind, you won’t have difficulty ordering your packages on Aliexpress.

You can check aliexpress support read more about vat

Aliexpress Help Center about VAT